Representative External Forecasts/Opinions

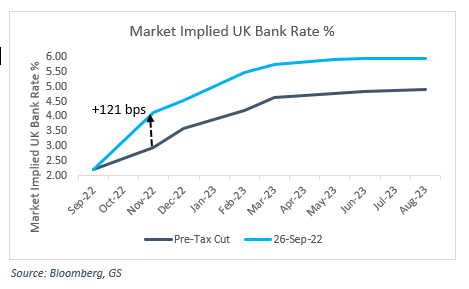

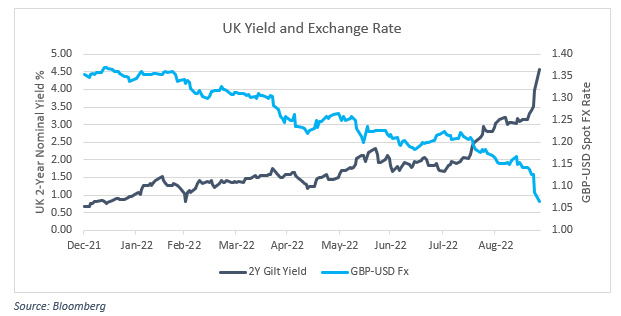

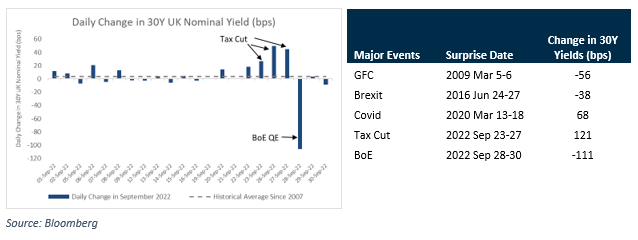

J.P. Morgan economists estimate that the impact of PM Truss’s fiscal package on near-term growth – that they expect to cost ~1.5% of GDP – is likely to be small. Their UK GDP forecast for 2023 was only raised from 0% to 0.3%[1]. A larger impact is possible once hard-to-measure confidence effects are factored in, but this is likely to be countered by additional BoE tightening. Large unfunded fiscal easing without independent review prompted an outsized sell-off in debt markets and a run on the currency since Friday 23 September 2022. Market nervousness will likely persist until the government provides a more sustainable longer-term fiscal plan.

Rachel Reeves, Labor’s Shadow Chancellor of the Exchequer, seems skeptical about the tax cuts being able to boost the economy[2]. She contends that trickle-down economics is no substitute for a growth plan. Ms. Reeves asserts that PM Truss’s plan seems to turn a blind eye to evidence and experience, the UK corporate tax levels are already below France and Germany, and they would have remained so at the planned 25% – yet UK corporate investment is still the lowest in the G7. She does not see any evidence that lowering the corporate tax rate to 19% will expand investment.

Ms. Reeves believes that to expand the supply side of the economy the UK needs to strengthen trading relationships, tackle long-standing weakness in the basic and vocational skills that hold back productivity, and help companies to start scaling up – including spinouts from world-class universities.

In an opinion piece in the Wall Street Journal, James Mackintosh highlights three major problems with UK’s new tax / stimulus plan[3]. First, unlike the early 1980s when Mrs. Thatcher introduced her reforms, British business isn’t currently being strangled by red tape, held ransom by powerful unions (a few critical industries excepted) or crippled by high corporate taxes. Second, the UK had debt of only ~40% of GDP and a small current account surplus in the early 1980s and there was considerable scope to borrow from abroad. Currently, the UK has a record current account deficit and a debt-to-GDP ratio greater than 100%, both of which the borrowing required to fund the new stimulus plan promises to exacerbate. Third, Mrs. Thatcher had a strong mandate to push through unpopular policies. allowing her to make big cuts in government spending to partially fund her tax cuts. This administration may not have that luxury, according to Mr. Mackintosh.

SECOR’s Views

In the short-term we expect there to be continued higher volatility until the market resets to a higher level of interest rates after getting a clearer picture on the implications of the new policy. We would try to avoid selling existing bond positions at these levels since transactions costs are extraordinarily high and there is a chance of getting whipsawed as markets either normalize and/or react sharply to new policy announcements. Positioning portfolios to be able to raise cash quickly for margin payments may be crucial in managing short-term extreme volatility. SECOR’s collateral management process is driven by three mechanisms to ensure liquidity:

- Maintenance of a centralized collateral pool; these assets are often overlaid with strategically relevant fixed income exposure,

- Daily monitoring of the portfolio’s Value-at-Risk (VaR) to forecast potential collateral requirements vs. current balances,

- Defining a liquidity waterfall with clear settlement timings to satisfy additional liquidity needs beyond 1 & 2.

We believe the collateral management process should be considered strategically in conjunction with a pension plan’s liquidity and asset allocation. This process enables our clients to use derivatives to manage a portion of their hedging while maintaining sufficient capital during stressful market events.

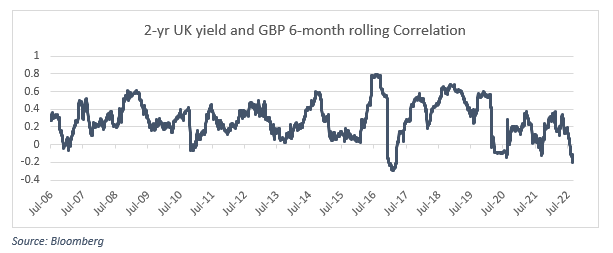

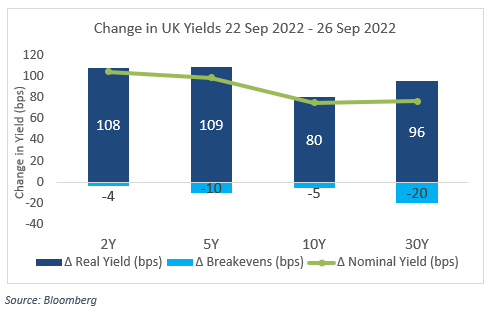

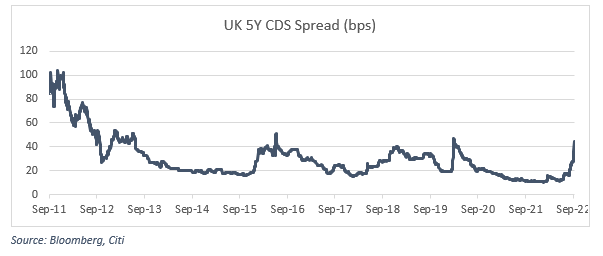

Over time investors need to understand if the new fiscal policy can overcome the shortfall in tax revenue. If it cannot, then markets are probably correct about demanding extra compensation through higher yields. PM Truss’s “mini budget” is at best a well-intentioned plan for addressing the UK’s major structural problems of lagging investment and stagnating productivity growth. Unfortunately, the program is ill-timed and entails considerable risk. The announcement of the program — which did not include an accompanying fiscal anchor or official Office for Budget Responsibility (OBR) analysis – contributed to significant uncertainty and prompted major sell-offs in fixed income and FX markets. Shocking markets with major policy changes may lead to unintended volatility and dysfunction as we witnessed in the US during the Taper Tantrum of 2013. More concerning is the seeming disconnect between increasing fiscal stimulus, while the BoE is trying to tame double-digit inflation. This appears to be a highly risky strategy that is likely to maintain upward pressure on rates and could even result in a tail risk of loss in confidence in the central bank’s ability to keep long-run inflation expectations reasonably contained.

In the long run, nominal rates resetting higher is normally advantageous for pension schemes since the liability value is inversely related to the level of rates. We believe liability hedging is an essential tool when managing assets against a liability because hedging helps mitigate funded status volatility. If rates continue to rise and funded status improves, we think pensions may want to consider increasing hedging ratios and locking in their funded status. We estimate that in the recent moves, pension schemes may have seen their funding levels improve by approximately 5% – 15%. We believe that the BoE’s (necessary) response should provide temporary relief; however, printing money may introduce more inflationary pressure in the market. We could also see yields rise again as investors turn their attention back to the fiscal stimulus. Overall, we think the coming months could provide a good opportunity to purchase hedging assets as funded ratios generally increase with rising yields.

Conclusion

The aggressive tax plan from the new UK administration has led to extreme volatility in the rates and currency markets. The markets are now pricing in approximately a 6% terminal rate in the UK by Q2 2023 and given the increased risks, investors are demanding a higher yield for lending to the government. Overall, we expect the fiscal package to have only a small positive impact to GDP and to the extent that it raises bond yields, it should reduce defined benefit liabilities. We will continue to actively monitor the situation and work to mitigate risk. We will also continue to look for tactical opportunities that may arise in potentially dislocated markets.