While Value companies in all regions have enjoyed a rebound in profit margins as economies have reopened, the rebound has been especially pronounced in Europe due to its high sensitivity to the global economy. Its index composition is more concentrated in economically sensitive sectors, such as Cyclicals and Financials than are other regions like the US and Emerging Markets that have a larger representation of higher growth technology-related companies. This concentration has driven a sharp snapback in margins for Value companies, increasing nearly fourfold from 2% in the third quarter of 2020 to 7.6% a year later.

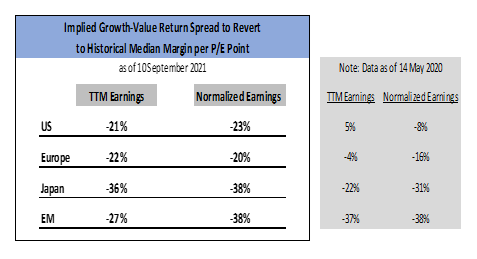

Despite the strong margin improvement in Europe, the Value opportunity appears brightest in Japan and Emerging Markets when considering valuation in the context of profitability. The case for Japan Value is driven by the extremely narrow profit margin advantage of Growth companies over Value companies – just 1.3% – despite a very wide spread in P/E multiples of 16.2x. Compare this to the US where the spread in P/E multiples is also wide at 19.6x but where Growth stock margins exceed those of Value stocks by a much more substantial 4.5%. The Emerging Market Value case is based more on relative P/E multiples, as Emerging Market Growth stocks are valued at 2.4x that of their Value counterparts, even higher than the 1.9x of the US. This wide disparity in relative valuations exists even after the recent rout in Chinese technology stocks that dominate the Emerging Markets Growth index. Additionally, profit margin contraction of those same China tech giants is almost a certainty given the recent regulatory crackdown which would further enhance the attractiveness of Value stocks in this framework.

Of course, Value investors have reason to remain skeptical that years of underperformance are about to reverse as previous Value rallies repeatedly stalled over the past fourteen years of this long and unrelenting Growth stock cycle. So where is the Value trap most likely to be hiding among the regions considered here? Europe Value may be the most likely candidate. The sharp improvement in Value profit margins has restored its profit margin to 7.6%, within 0.5% of its pre-COVID level of 8.1%. That level has only been surpassed once in the last 25 years when Value margins peaked at 9.9% in the fourth quarter of 2007, just before plummeting during the Great Financial Crisis. The current elevated margin for European Value companies still pales in comparison to the US and Emerging Markets with profit margins of 9.3% and 10.2% and is only modestly higher than that of Japan at 6.4%. Japan Value stocks, though, sell at only 12.2x what are likely near-peak margin earnings versus 15.1x in Europe. Emerging Market Value is both cheaper and more profitable than Europe while US Value, although more expensive on a P/E basis also holds a wide edge in profitability. Ultimately, attempting to identify a single market most susceptible to the proverbial Value trap may be just as futile today as it has been since this Growth cycle commenced with the Great Financial Crisis, sparing no region from Value underperformance.

Are We There Yet?

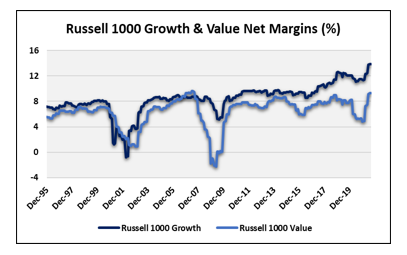

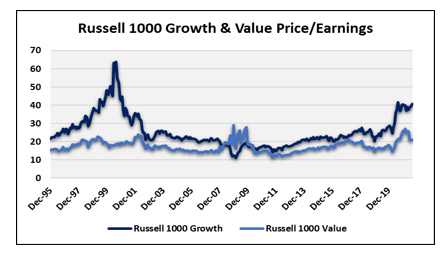

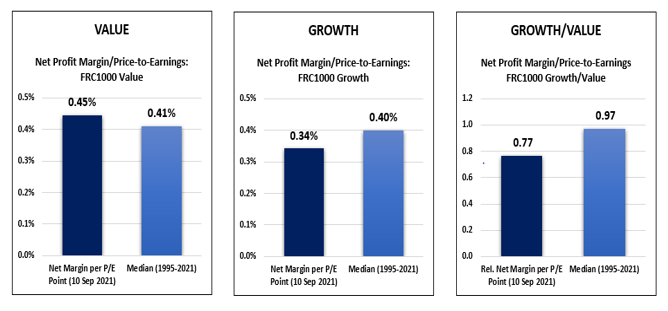

Despite favourable profitability-adjusted valuation metrics, Value stocks still face challenges in closing the return gap with Growth stocks. In the near term, delays in reopening due to Delta variant concerns have disproportionately impacted the cyclical-heavy Value companies, especially in the Travel and Leisure sectors. Probably a more challenging task for value companies in the longer-term is in narrowing the persistent profitability gap with Growth stocks. While Value margins in the US have fluctuated around an average of 6%, Growth margins have marched steadily higher from roughly 7% in the late 1990s to today’s 13% with only a few interruptions. This margin expansion has been fuelled by the rise of the tech giants and their lucrative and seemingly unassailable platforms. And unlike many Value companies that weakened since the onset of COVID, these companies are emerging from the pandemic with arguably stronger franchises and even more dominant market positions.

The case for Value stocks, though, is not without merit. Investors have taken note of the high and growing margins for Growth stocks and have now assigned a P/E multiple to current earnings that can only be justified by continued rapid earnings growth and margin expansion relative to Value stocks. Such high expectations ultimately make Growth stocks vulnerable to disappointment should they fail to deliver on those increasingly lofty expectations. The argument against further increases in Growth margins has been advanced many times over the past twenty years, however, and have repeatedly been proven wrong. But there is a limit to how much further margins can expand before either attracting competition, or perhaps more likely, the intervention of regulation to foster increased competition. Indeed, the recent regulatory crackdown in China on its technology giants is perhaps a more draconian version of what is to come in the US where the Biden administration has signalled its intent to intensify scrutiny of its largest technology companies. Finally, the days of repressed interest rates by Central Banks that have benefitted longer duration Growth stocks may be numbered as taper talk intensifies around the world, with the potential normalization of interest rates reversing a multi-year headwind for shorter duration Value stocks.