Fortunately, the “new dawn” embodied in the sagacious-monetary policies initiated in the early 1980s eventually set the stage for a multi-decade economic expansion and disinflation. The decisive-policy responses implemented by central bankers in the early 1980s — epitomized by Paul Volcker’s setting monetary growth targets and letting interest rates adjust freely — resulted in rates rising to unprecedented levels before eventually restoring confidence and taming inflation[3].

The Latin American debt crisis triggered by Mexico’s default in 1982 — the final pivotal event referenced in our overview of policy issues of the period ending in early 1980s — underscored that trading partners and debtor nations with large budget and/or current account deficits can create significant risks for investors, [4]particularly in a world with flexible exchange rates and large global capital flows.

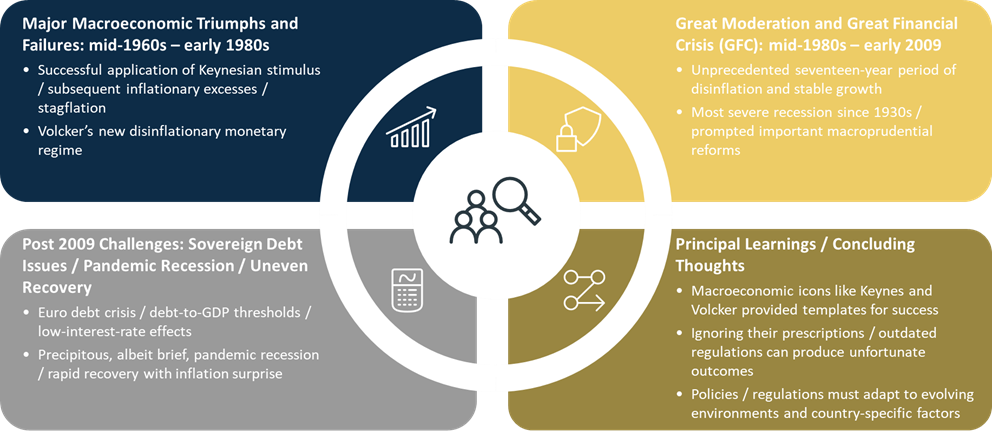

Mid-1980s to Early 2009: Great Moderation and Great Financial Crisis (GFC)

The adjective “great” is used to depict each segment of the bipolar macroeconomic experiences of the mid-1980s to the early-2009 period. Relative macroeconomic stability prevailed throughout much of the industrial world during the some-seventeen years of the Great Moderation and then near the end of 2007 the global economy was beset by the Great Financial Crisis.

The slowing in inflation during the Great Moderation is widely attributed to sound macroeconomic policies. In contrast, while most economists concur that judicious monetary policies were important contributors to the lower volatility of quarterly-growth rates, structural changes such as increased globalization, shifts to services, better inventory control, and perhaps “good luck” are also frequently identified as significant contributors to the low volatility of output during the Great Moderation[5].

The Great Financial Crisis — the most severe global downturn since the Great Depression of the 1930s – prompted much soul searching. Leading academics, central bankers, and market practitioners are yet to reach complete agreement on what went wrong.[6] How did the housing bubble, excessive leverage, and the opaque-financial instruments come about and precipitate a financial apocalypse? Was Hyman Minsky[7] right that periods of prosperity would foster excesses and lead to an eventual collapse? Should central bankers have tightened their policies before the stock market or housing bubbles formed? Was the regulatory framework inadequate, particular for the “innovative” financial instruments that had come to the fore?

While there may be some lingering disagreements about the catalysts that paved the way for the GFC, we know much about what went awry and what needed to be fixed. Our financial regulatory framework was inadequate in 2007 and suffered from errors of omission and commission. Regulations failed to stay abreast of financial innovation. The new structural products that were marketed to institutional and retail investors lacked sufficient transparency. They were frequently based on opaque models of financial engineers which imbedded unrealistic assumptions[8]. Sufficient account was not taken of rating agencies’ conflicts of interests, particularly with respect to structured products. Reporting standards for swaption transaction did not keep pace with the rapid growth of this important sector of the financial markets. At the same time, some regulatory initiatives seemingly facilitated excesses. For example, many observers attributed the huge increases in leverage among the investments banks that presaged the GFC to an SEC rule change in 2004[9].

The belated recognition of the crisis also added to its severity, In the spring of 2007 when concerns about subprime-mortgage defaults started to percolate key policymakers such as Ben Bernanke continued to contend that “significant spillovers to the economy or the financial system were unlikely”[10]. Then, when Northern Rock Bank — the biggest UK player in the securitization market— suffered a depositor run in September 2007 it became apparent that the US subprime problems were a “canary in the coal mine” for a systemic-global crisis that required immediate attention. Before the bleeding stopped in early 2009 some elite firms such as Bear Stearns and Lehman were forced to close their doors, while others such AIG and Merrill Lynch had to restructure or merge. And global policymakers had to implement unprecedented fiscal and monetary stimulus to maintain liquidity and restore confidence. The most important legacy of the GFC for today’s investors is the regulations that were put in place in the wake of the GFC.

The ex-post analysis and the changes that were implemented in the aftermath of the GFC have largely focused on macroprudential policies. Prosperity per se was not viewed as a cause of the collapse and monetary policy was largely considered to be too blunt an instrument to prevent bubbles. Legislators and regulators around the world, however, have tightened policies and appear to be moving toward an enhanced macroprudential framework to foster stability[11]. The Dodd-Frank Act that was enacted in the US in 2010 embodies a macroprudential framework for mitigating systemic risk. The Basil III International Agreement has increased global bank capital and liquidity standards and US banks are now required to take stress tests regularly.

The post-GFC regulations may not specifically address all that went awry before the GFC or make policymakers more prescient. But we are reasonably confident that the reforms aimed at increasing bank capital and assuring that liquidity will be maintained in future periods of stress will significantly reduce the risk of future financial crises. Although “one swallow doesn’t make a spring”, the new macroprudential policies have seemingly passed their first-live test as the global financial system has seemingly emerged from the 2020 pandemic recession in a relatively strong position.

2009 to Present: Euro Debt Crisis Averted/ Sovereign Debt Safety / Global Pandemic

In the decade following the world’s exit from the GFC the euro debt crisis and several questions related to sovereign debt safety came to the fore. Growing doubts about Greece’s ability to satisfy its sovereign debt obligations surfaced in 2009 and eventually raised concerns about several other euro area countries[12]. The dramatic moment that is credited with averting a collapse of the euro is the reassuring words in July 2012 from the head of the ECB, Mario Draghi: “Within our mandate, the ECB is ready to do whatever it takes to preserve the euro. And believe me, it will be enough[13].”

Although the other sovereign-debt issues—debt to GDP ratio thresholds and the relationship between current interest rates and nominal growth rates, — referenced in this review may not be tied to specific major policy decisions, they are potentially important issues for macroeconomic policies. For example, key policy makers have frequently referenced the government debt thresholds cited in Carmen Reinhart and Ken Rogoff’s best-selling book that was published in 2009. Based on their analysis of 800 years of data, they concluded that when an advanced country’s government debt-to-GDP ratio reaches the “critical threshold” of 90%, median growth rates decline by 1%. And in emerging markets countries when external debt reaches 60% of GDP, annual growth declines by 2%[14]. While there is a reasonable-intuitive case for arguing that high-debt levels should slow growth, some prominent academics have criticized the findings presented in this popular book. The authors excluded key variables such as interest rates from their analysis; they based their conclusions on correlations rather than causation; and technical errors were uncovered in their analysis[15].

It is not surprising that in the low interest rate environment of the post-GFC decade the potential effects of low interest rates on debt capacity resurfaced as a topical issue. Olivier Blanchard’s widely quoted article published in a prestigious economic journal in 2019 reminded us that when debt servicing costs are below nominal GDP growth rates, relative debt burdens will decline over time[16]. While this observation is arithmetically correct and a reasonable consideration in a low-rate environment, it is not always applicable in a world in which neither interest rates nor nominal growth rates are fixed.

In fact, earlier this year Blanchard published a follow-up piece cautioning against using simple rules to decide when public debt becomes unsafe[17]. In this regard, he noted that the macroeconomic environment is dynamic and not static. Assessing the safety of the debt of a specific country requires more than projecting growth and interest rates. It requires assessing country-specific factors such as current account balances and the currency in which the debt is denominated.

Then in 2020 COVID-19 — the first global pandemic in over a century — provided macroeconomic policymakers and the medical community with new and herculean challenges. Looking retrospectively at the events of 2020, the performance of policymakers and the medical community, in my opinion, deserves high grades. Lockdowns and virus concerns in 2020 plunged the global economy into the severest recession of postwar period. But, at the same time, unprecedented fiscal and monetary stimulus and medical advances, particularly new vaccines, paved the way for the pandemic recession to be the shortest in post-war history. Consumers and businesses emerged from the recession in strong financial positions and the global economy experienced robust growth in the latter half of 2020 and in 2021.

Policymakers, however, could only rest on their laurels briefly. The macroeconomic backdrop continued to evolve and by the end of 2021 it was apparent that rising inflation was a problem that needed to be addressed. Supply/demand imbalances, labour shortages and most recently, the additional pressure on commodity prices from Russia’s invasion of Ukraine have exacerbated inflationary pressures. Unfortunately, some economies may experience recessions which hopefully will be relatively mild before the current inflationary episode is contained. And with long-run inflation expectation still anchored and monetary policy moving toward normalization, prospects for inflation decelerating over the cyclical horizon remain favourable.

Principal Learnings / Concluding Thoughts

The triumphs and miscues attributable to macroeconomic policies over the past half century have provided a valuable learning experience. Our overarching message is that today’s macroeconomic policymakers have inherited a rich legacy. Icons of the past such as Keynes and Volcker have passed on to their successors the principles that they need to follow to assure success. History has demonstrated that ignoring these sound principles and regulatory errors of omission and commission can produce unfavourable outcomes.

Policymakers, however, must also take account of the evolving global economic backdrop to achieve the best possible outcomes. Simple rules of thumb are not sufficient. Even Milton Friedman, whose name is synonymous with fixed-monetary growth targets, noted in a 2003 article[18] that he had some misgivings about inflexible monetary rules. Policies need to adapt to an ever–changing external environment: interest rate levels, market expectations[19], and financial innovation as well as to the specific circumstances facing individual countries: access to capital markets, expected growth rates, debt servicing commitments, and rules such as membership in a monetary union that may apply.

The macroeconomic backdrop that we are likely to face in the foreseeable future with record public debt levels and rising interest rates promises to be challenging but hopefully the learnings discussed in this brief report will provide a useful roadmap, albeit an imperfect one, for policymakers and investors to address and assess the challenges that lie ahead.