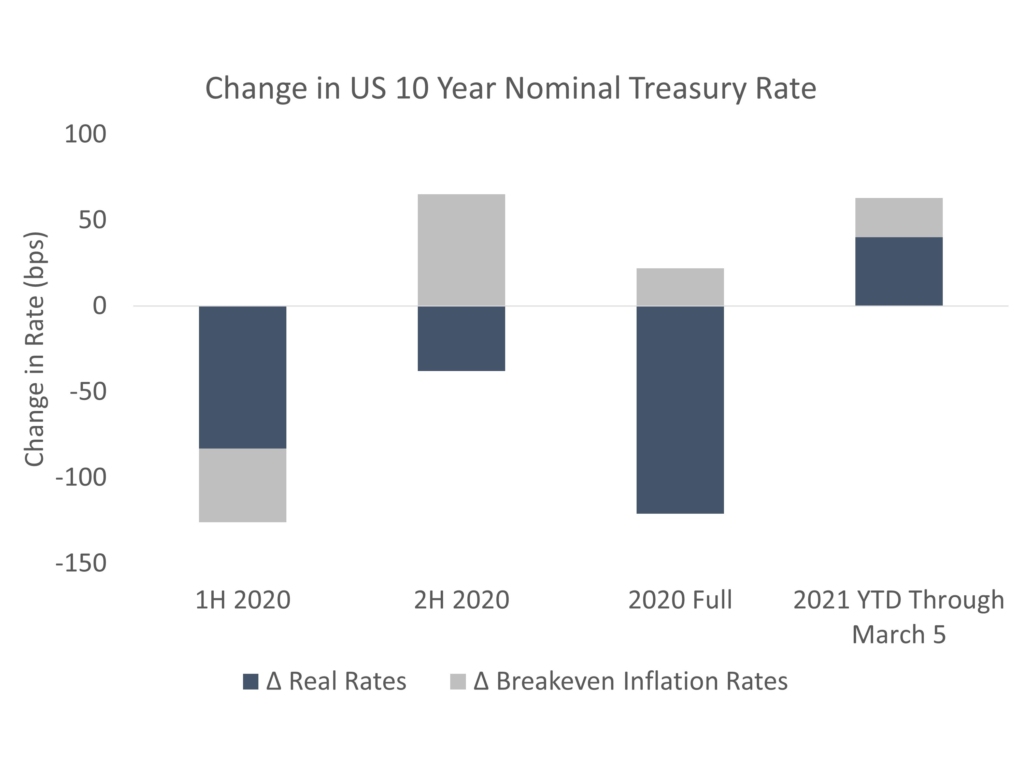

We believe a significant portion of the recent rise in both real yields and inflation has been supported by fundamentals as the market began repricing its perception of the Fed’s neutral rate from 1.75% in January to closer to 2.25% as of March 5, 2021. This is nearing the Fed’s long run estimate of a 2.5% neutral rate. As illustrated by the chart on the previous page, inflation expectations and real yields decreased dramatically in the first half of 2020 with worsening economic prospects. Inflation expectations increased over the last 6 months of 2020 while real yields continued to fall. However, the recent change in yields has also been driven by a rise in real rates – up 0.4% from February 10, 2021 to March 5, 2021. Powell was suggesting we have had a healthy increase in real yields with the improving economic outlook. However, it is a fair concern that a sharp rise in real yields might lead to decreased spending/higher savings and a stronger dollar, leading to potentially tighter financial conditions.

One thing we are closely watching is the shape of the yield curve. It is possible that some sort of weighted-average maturity extension could come back into focus if there are further signals of difficulties in market liquidity from lack of digestion in the long-dated supply. Yield curve control has come up in conversations lately, but it is important to note that in past instances where the possibility was raised, the style was much closer to Australia, which has been targeting around the 3 year point on the curves, than the BoJ’s program. In that case it would be more of a supplement to forward guidance than something being used to anchor longer maturity yields, instead of reinforcing the Fed’s commitment to keep short-term rates anchored for the time being. Much of the early repricing in yields was driven by the backend of the curve.

While that may tighten financial conditions, to some extent risky assets were resilient to this move as it reflected better fundamentals – the repricing of the terminal rate reflects higher growth and inflation expectations. That would potentially shift the curve dynamic with the un-anchoring of the belly and the short-end. Risky assets are much less resilient to this move because instead of reflecting better fundamentals it may reflect an earlier-than-expected removal of accommodation.

Market participants did not appear to find Powell’s comments very reassuring. The markets were likely hoping that there would be some suggestion that higher bond yields alone were a problem (or could become one), which would imply that the Fed would not need broader financial conditions to tighten but rather they would just need yields to get high enough “to do more”. There was probably also hope for a firmer commitment to a specific timeline or stance (such as, “we won’t taper this year regardless of how good the data is”). Absent that, there is an innate exposure to shifting perceptions on the economy feeding into a shift in how markets price the policy cycle. An inherent challenge of Fed guidance is that if you are heading into a period where data are expected to be very strong, it is natural that the market would price for a somewhat faster timeline of policy normalization.

We also attribute this seeming elevated uncertainty to Powell’s difficulty in reassuring concerned market participants in the middle of a storm rather than uncertainty about the direction of Fed policy. Based on our readings of Powell’s recent speeches and other members of the Fed Board, we believe that the communications from the upcoming March meeting will clearly and unequivocally reiterate their case for keeping rates low for longer. These factors include inflation expectations are still contained and in line with Fed’s targets, the increase in inflation in 2021 is expected to be transitory (since it is largely due to base effects – comparisons with depressed levels in 2020 when lockdowns brought activity to a virtual halt), employment is still 8.5 million below a year ago and the broader unemployment rate that includes discouraged workers is still in double-digit territory. It remains to be seen whether the market expectations for the Fed’s first rate increase taking place at the end of Q1 2023 and QE (quantitative easing) trimming will start in early 2022, but we expect the March communication to be a strong defense of current policies.

Our strategic positioning for clients is based on longer term targets and goals and is generally not impacted by shorter-term market moves. We continue to monitor the economy and markets and will consider tactical views where they are appropriate.