Risks of the Transitory Inflation View

By Dmitri Smolansky

October 2021

“The market-based and survey-based measures that the Fed looks at indicate that inflation expectations have made a welcome return to levels more consistent with its inflation goal but have not risen as fast as actual inflation, suggesting households, businesses and market participants also believe that current high inflation readings are likely to prove transitory,” Federal Reserve Chair Powell stated in his remarks addressed to the Kansas City Fed’s annual Jackson Hole economic symposium on August 27, 2021. Broadly speaking, we agree with Fed’s position – but we recognize the risks associated with this view.

It is in line with its new framework, where inflation is allowed to overshoot, and the Fed focuses on average inflation and full employment. In addition to the short- and medium-term economic data, we believe the Fed’s economists are also monitoring relevant longer-term forces and variables such as globalization, workers bargaining power, government regulations, etc. Arguably, the Fed is well equipped to accurately reflect all these complex relationships in its decision-making, which, correspondingly should result in a stable interest rate environment and support economic growth and equity market conditions. At the same time, allowing inflation to overshoot, and an unprecedented post-pandemic economic environment create more uncertainty than usual and make the Fed’s job more difficult. In addition, investors still do not know the level at which the Fed is going to view inflation as “too high”.

In assessing how to benefit from this environment, we need to balance our view of what should work when inflation runs high with our understanding of what is already priced in the markets. For example, even though Powell was dovish in Jackson Hole, bond yields are actually higher now than they were before his speech, which suggests bond market already expected this view. Over longer-term, interest rates react to inflation surprises rather than to the head-line numbers, but on a day-to-day basis, yields can move with changing market expectations, positioning, etc.

Importantly, we also need to think of alternative economic and market scenarios, many of which could create inflation mitigants. For example, there are signs that productivity could be increasing as a result of faster implementation of technology, which could reduce inflationary pressures over time. If current estimates of corporate and consumer spending prove to be overly optimistic, demand pressures could subside, at least over near-term.

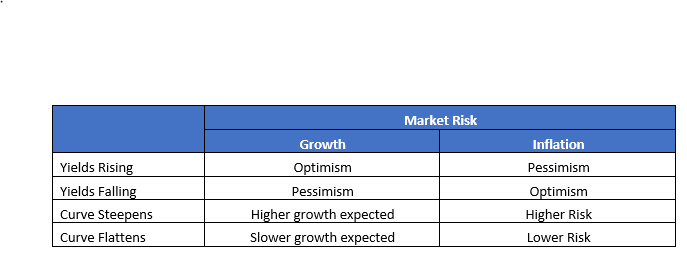

We believe that market participants started viewing inflation, in addition to growth, as the major risk factor. As a result, many of the established cross-asset relationships should be re-evaluated – which may cause a shift in asset allocation and/or notable changes in sector positioning within your manager portfolios. We summarize the typical trading relationships below.