SECOR ESG & Corporate Responsibility – “Is a Carbon Offset programme right for you?”

By Andrew Bang

February 2021

As the ESG and Sustainability movement has grown across multiple fronts in recent years, SECOR is not alone in embarking on a journey to incorporate ESG and Sustainability practices into the way we operate. We recognise the responsibility of being a good global corporate steward and the importance of ESG considerations in advising our clients, selecting managers, and assessing investments and solutions. We believe that ESG beliefs are aligned with our overall investment beliefs and long-term investment process. Whatever your views may be on ESG and climate change, numerous organizations, investors and individuals are carrying the ESG and Sustainability banner while, at the same time, regulators may seek to penalize those who engage in “green-washing”. Globally, regulations that make certain practices compulsory, followed by potential penalties and taxes for non-compliance, may be around the corner. The Carbon Disclosure Project estimates the effects of negative impacts on corporate earnings to be over $1 trillion.[1]

Members of the UN-backed Net-Zero Asset Owner Alliance will set decarbonisation targets for 2025 as part of wider efforts to align their portfolios with the Paris Agreement[2] climate goals and achieve net-zero emissions by 2050. Asset owners have been leading the way as “thirty of the world’s largest asset owners, with portfolios worth a combined $5 trillion, have committed to cutting carbon emissions linked to companies they invest in by up to 29% within the next four years.”[3]

What is Carbon Offsetting?

Carbon offsetting[4] is a widely recognised process that seeks to take responsibility for unavoidable carbon emissions. Such initiatives are aimed at reducing greenhouse gas or carbon dioxide emissions by compensating for or neutralizing the emissions created. This allows individuals and institutions to achieve parity between the carbon dioxide created and the carbon dioxide they reduce in the atmosphere – providing companies an expedient way to achieve carbon neutrality. The programs typically make an investment in environmental projects such as clean energy technologies or planting trees, with the objective of offsetting carbon or reducing future emissions. Some consider it to be a faster way to achieve emissions reductions and an approach to achieve carbon neutrality. Some benefits of carbon offsetting include:

- Easy way to lower emissions without disrupting existing systems and structures

- Funds projects to help reduce greenhouse gas emissions (e.g. tree planting, wind, solar, hydro-electricity, methane reductions)

- Potentially work directly with communities to clean rivers, plant trees, lessen dependence on oil, and invest in clean energy

- Many carbon offsetting programs allow for specific or directed projects

Ongoing Debate on its Effectiveness

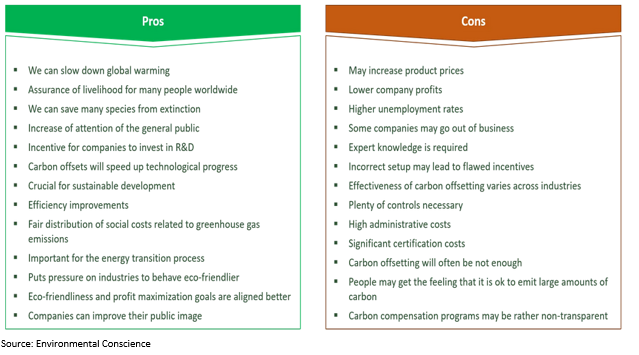

There has been some debate about the effectiveness of carbon offset projects. Some argue philosophically that carbon offsetting gives license to continue to pollute the environment or offsets may allow bad actors to continue producing carbon emission. If an organization buys carbon offsets, they can pollute the environment without concern or guilt and without making long-term efforts to reduce emissions by using less fossil fuel or take other carbon-reduction measures. There are practical concerns about the accuracy of metrics and monitoring processes or issues with some projects. As an example, there has been instances where tree planting projects have failed or had problems due to mismanagement or illegal logging. The chart below lists some pros and cons regarding the use of carbon offsets.

While no system is perfect, many of these concerns have been acknowledged and are being tackled as both carbon standards and practices have been evolving.

As an example, the airline industry currently uses offsets as there is no practical means for airplanes to fly without fossil fuels. A recent international airline industry agreement known as CORSIA seeks to freeze 2019/2020 emission levels and pledged to offset any increase in emissions effective 2021.[5] United Airlines however has taken an independent stance from the broader industry where they announced that they would avoid using carbon credits and plan to invest in biofuel research & direct air capture. Critics of this plan could argue that biofuel research would not be effective or that United’s efforts or investment are not sufficient to have an impact.

While the use of carbon offsets as an ideal method for reducing an organization’s carbon footprint can be debated, it is generally accepted that the best means of carbon reduction is to avoid unnecessary carbon emissions altogether. However, where carbon emissions cannot be reduced, we believe carbon offset programs are worthy of consideration and inclusion as part of a broader approach to sustainability.

What is SECOR doing?

SECOR has been actively working with asset owners to develop ESG policies and integrate ESG and Sustainability practices into their investment processes. We have been monitoring various managers’ progress in building and implementing ESG policies. In the last three years, we have observed investment managers take steps to make substantive advances in ESG integration, enhancements in their sustainable practices and develop responsible investment programs.

SECOR understands that every investor has unique ESG and Sustainability beliefs and should develop an approach consistent with their core beliefs in a tailored approach, which could take any one of numerous forms. We believe that responses to climate change should be customized to each asset owner or investor’s investment approach and asset class mix. Our next steps may include the measurement of a portfolio’s carbon footprint, engaging with companies on transitioning to a low-carbon economy or accelerating newer forms of investment. We believe dialogue and engagement with asset owners and investment managers are essential. We are considering requiring managers to provide portfolio carbon footprints data as well as specific analysis of ESG factors and climate change impact. Developing and implementing ESG and Sustainability programs that include carbon emission reduction or various de-carbonization efforts will take significant time, effort and resources. While these programs are implemented and remediation efforts are ongoing, a carbon offset program may be able to provide a temporary or part of the solution for some investors.

In addition to advising and working with clients on ESG investment processes, SECOR as a firm has implemented various ESG and sustainability initiatives in the workplace including:

- Energy efficiency projects, and recycling efforts

- Relocated the headquarters office in New York City to a “state of the art” LEEDs certified energy efficient space

- Long before the COVID -19 pandemic, SECOR has been making extensive use of videoconferencing technology in order to reduce the air travel required by in-person meetings

Having assessed the pros and cons of carbon offset programs, based on our beliefs and needs, we engaged a third-party service provider Carbonfund.org Foundation (see Appendix) to assist us in carbon offsetting efforts where air travel is required.[6] SECOR as an organization has taken the voluntary approach, through self-directed goals to endeavour to reduce or cut carbon emissions. As a supplementary effort aligned with our overall ESG and Sustainability program, SECOR hopes to do more for the environment through this carbon offset program.

[1] Carbon Disclosure Project 4 June 2019. https://www.cdp.net/en/articles/media/worlds-biggest-companies-face-1-trillion-in-climate-change-risks

[2] Paris Agreement under the United Nations Framework Convention on Climate Change

[3] The Guardian 13 Oct 2020. https://www.theguardian.com/environment/2020/oct/13/top-asset-managers-commit-to-big-carbon-emissions-cuts

[4] The general term “offset” was popularized after The Clean Air Act of 1970, passed by Congress in 1970, stated that high-volume emissions would only be permissible if the polluter reduced emissions (offsets) in other locations.

[5] ICAO CORSIA https://www.icao.int/environmental-protection/CORSIA/Pages/default.

[6] For illustrative purposes only, not an endorsement or recommendation. There are many organizations that provide carbon offset programs (representative sample in Appendix) that could meet your organization’s needs with your thoughtful consideration.