By Ken Frier, CFA

August 2021

The UN PRI and an increasing number of investment consultants recommend that allocators imbed Environmental, Social, and Governance (“ESG”) considerations at the top level, within the Strategic Asset Allocation (SAA). In SECOR’s view, there remains insufficient evidence to accurately determine ESG-related risk or return adjustments within the SAA process. In addition, there are drawbacks to applying ESG-motivated tilts to broad asset categories or investing through ESG-oriented index funds. Our view is that the greatest potential from the application of ESG to investing is as close to the actual investment as possible. It is preferable to have the ESG assessment made by an ESG-savvy investment manager in direct contact with the security issuer, who asks about ESG practices and integrates ESG into the security selection process. We also believe the greatest potential for integrating ESG with investment selection is found in private equity and real estate markets rather than public securities.

An allocator who wishes to incorporate ESG principles in the portfolio has choices which are analogous to the choices available to implement a Value orientation in global equity investing. Ways of applying Value tilts to global equities include:

Our belief is that the third choice has the most potential to generate satisfactory results from Value investing, and the first choice has the least potential. Similarly, we believe that active management by ESG-oriented managers who know the issuers they are evaluating has more potential to achieve investment and ESG aims than ESG implemented at the SAA level or ESG-oriented index investing.

ESG in Strategic Asset Allocation (SAA)

Most of us have an SAA process which requires estimation of the return and risk of each available investment category. Since ESG factors impact the return and risk of investment securities, an ESG-aware process has the potential to improve our estimates. We believe any ESG-related improvement in assumptions for either the risk or the return dimension would be worthwhile to pursue. But these ESG adjustments are difficult to validate, and there is more potential benefit from differentiating among companies than differentiating among asset classes.

To include ESG in the SAA, one needs estimates for how much asset class risks or returns will be impacted by ESG considerations. How accurately can these be predicted? For instance, suppose one wants to make proper adjustments for the impact of climate change on investment returns. To help investors with this, the UN PRI has commissioned a project called The Inevitable Policy Response (IPR). The premise is that it is inevitable (or at least quite likely) that global governments will take coordinated action to achieve the ambition from the Paris Accord to limit global temperature increases to no more than 1.5 degrees Celsius. The IPR work recommends that allocators adjust forecasted asset class returns based on the specific policy measures anticipated by the IPR project. But what if governments make different choices than the ones expected, or fail to agree on a coordinated response to climate change?

Recommendations for integrating ESG into Strategic Asset Allocation can lead to similar impulses, such as a tilt away from carbon-intensive industries. An April 2020 report indicated that 1,192 institutions and 58,000 individuals, representing over $14 trillion in assets, had begun or committed to a divestment from fossil fuels[1]. The long-term impact of these shifts by large allocators should be to raise the cost of capital for energy companies. Raising the cost of doing business for energy companies is probably a desired impact of these portfolio shifts, because this will get the attention of corporate management. However, a higher cost of capital for these businesses also means a better entry price for the investors who remain, so the classic economic conclusion would be that the shunned sectors will eventually be poised to deliver relatively favourable returns.

What about the companies in the Energy sector with positive ESG practices? On average, the ESG ratings from Sustainalytics are much higher for Information Technology companies than Energy companies. But one-third of the companies in the Energy sector of the S&P 500 have higher ESG scores from Sustainalytics than the average InfoTech company[2]. Using ESG screens to avoid whole sectors punishes saints and sinners alike. It is more effective to implement ESG through active managers who can make informed and targeted ESG choices company by company.

If one could be confident that carbon-intensive industries would deliver low returns, then standard portfolio optimization would naturally lead to a low weight to the energy sector. The conundrum for fiduciaries is the possibility that categories which are being avoided for ESG reasons will (because of the avoidance) become high expected return categories, leading to a potential conflict between the goal of maximizing risk-adjusted returns and the goal of advancing ESG interests. This is an area of ongoing debate, with some research suggesting better ESG practices lead to higher risk adjusted returns, on average, and other research saying the opposite[3]. These conflicting research results indicate the difficulty of being confident when one applies ESG-related shifts to return or risk assumptions utilized in Strategic Asset Allocation.

ESG Index Funds

Implementation of ESG considerations via index funds looks like a step in the right direction for those (like us) who believe that application of ESG tilts at the SAA level lacks a strong foundation in research evidence. The ESG evaluators whose ratings inform these index funds, including Sustainalytics, MSCI and S&P/RobecoSAM, deserve a great deal of credit. Their efforts have been instrumental in raising the priority of ESG concerns among corporate boards and investors. However, there are shortcomings in the index investment strategies which rely on these ratings alone.

One drawback in applying the ESG ratings is comparability. The rating providers use different criteria with different weights, which can result in a corporation scoring well with one system and poorly on another. For instance, Apple Computer currently has a favourable “Low Risk” ESG rating from Sustainalytics and a top-notch governance rating from ISS, and yet a low BBB rating from MSCI and a quite unfavourable rating from S&P/RobecoSAM[4]. An OECD survey of different ESG rating providers found an average R-squared of only about 0.20 for predicting the ESG ratings from one provider using the ratings of another, where an R-squared of 1.0 would mean the ratings from different providers were perfectly in alignment[5].

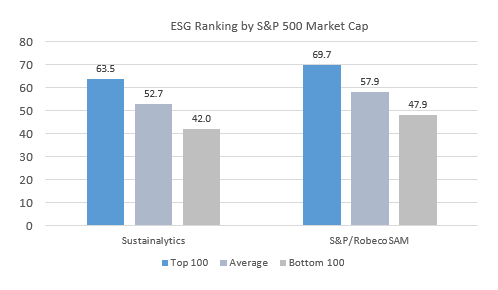

Furthermore, only the large companies have ESG ratings, and these large companies also have more resources to manage their ESG profile and outcomes. The chart to the right shows the average ESG scores for the S&P 500 organized by market cap, using Bloomberg’s reporting of the ESG rankings from Sustainalytics and S&P/RobecoSAM[6]. The companies in the top 100 by equity market capitalization have much more favourable ESG scores than the bottom 100. This is in part due to the prevalence of technology stocks (which have higher ESG scores, on average) among the largest companies. In general, reliance on these ESG ratings providers will tend to bias investments towards the larger capitalization companies.

In addition to the large-cap bias, ESG index funds tend to imbed sector biases. For instance, the FTSE USA All Cap Choice Index has about a 5% combined overweight to Information Technology and Health Care, with a matching 5% underweight to Energy and Industrials[7]. Those have been fortuitous tilts, particularly in 2020, and in general ESG-related funds have had better performance than the capitalization-weighted indices in recent years due to the huge gap between the performance of tech stocks versus energy stocks, as well as the outperformance of large cap vs. small cap stocks. Yet it is unclear (and likely impossible to determine accurately) how much of the recent performance edge of ESG-oriented equity index funds can be attributed to the tilt towards better ESG practices, rather than to other factors. Of course, it is also unclear whether the bias towards large cap tech will continue to reward investors in these ESG index funds going forward, given the currently elevated valuations of that group of companies.

ESG through Active Management

Rather than impose sector tilts or require use of broad ESG ratings, SECOR prefers external investment managers who genuinely integrate ESG considerations into their investment choices and who are active owners through the investment process. We prefer investment managers who were early in understanding the impact of ESG considerations on risk and return. It takes careful inquiry to distinguish investment managers who conscientiously and consistently imbed ESG in their investment process from those who are merely attempting to create an appearance of doing so. Our evaluations of ESG-focused managers include additional screening criteria to identify and exclude any managers the industry may view as “greenwashers”. While we carefully evaluate the ESG orientation of our managers, we also do not believe a focus on ESG, on its own, is sufficient to generate reliably superior active management returns over the long term. To pass our evaluation a manager must combine a facility in ESG with additional sources of demonstrated expertise in security selection.

It should be noted, however, that the problem of accurately evaluating the impact of ESG characteristics on investment outcomes remains. In our experience most (if not all) active managers, even those with a long history of considering ESG factors, cannot clearly articulate a specific or systematic approach for translating ESG attributes into the expected risk or return of the securities being considered for investment. Application of ESG criteria remains subject to the informed judgment of the manager. Nevertheless, among the choices of how to implement ESG in a portfolio, we simply would rather have ESG-related judgments made by those who have a thorough understanding of each company’s ESG practices, rather than try to impose aggregate judgments on whole asset classes. We also believe that an investment manager raising ESG concerns directly with the issuer has greater potential for influencing corporate management and generating beneficial ESG outcomes.

We believe Impact Investing is another promising application of ESG where the decisions are made at the manager selection level rather than the strategic asset allocation level. It is our view that opportunities for positive investment and ESG outcomes can be found in all asset classes, with the most promising being in alternative investment categories such as private equity and real estate. The greater ESG-related potential from impact investing through these alternative asset classes arises from:

We believe the ideal outcome from Impact Investing is the “double bottom line”, superior investment returns combined with a beneficial social impact. However, a double bottom line is by no means guaranteed. For instance, Barber et al. (2020) found that venture capital funds which had a dual mandate to generate financial returns and have a social impact generated returns which were 4.7% lower than funds with comparable characteristics[8]. For client portfolios, we seek Impact Investors whom we expect to generate at least the peer group return while also pursuing ESG objectives as part of the investment process. If the investment outcome is at least as good as the peer group, clients meet their fiduciary responsibilities while also achieving an ESG benefit. Skill in evaluating alternative investment managers and their potential projects is essential here.

SECOR’s primary goal in designing an investment strategy is to maximize net total returns within specified constraints, using long-run, high-confidence return and risk assumptions. While there is a growing body of research on the inclusion of ESG considerations at a strategic level, the findings are not yet conclusive. A wide range of ESG factors can be considered to express a client’s views or preferences, however, at present there is insufficient historical data and evidence demonstrating that ESG is a reliable strategic return source or diversifier. The lack of a consistent accepted method for evaluating security issuers on ESG factors is one of the obstacles to reaching a definitive conclusion regarding the investment return and risk implications of ESG. We are evidence-driven investors who believe in the importance of applying ESG considerations to investment choices. Based on the evidence at hand, until more is known about the influence of ESG considerations on the results of investment categories, we believe ESG implementation is best achieved as close to the security issuer as possible, with the greatest potential arising from Impact Investing via long-term private partnerships with well-defined ESG mandates.

[1] “Divestment Commitments”, Gofossilfree.org, 11 April 2020

[2] Source: Bloomberg

[3] For instance, an NYU study of 1000 ESG-related research papers indicated most concluded that ESG added value: (https://www.stern.nyu.edu/experience-stern/about/departments-centers-initiatives/centers-of-research/center-sustainable-business/research/research-initiatives/esg-and-financial-performance). Scientific Beta followed up debunking the favorable conclusions: Bruno, Esakia, Goltz, “Honey I Shrunk the ESG Alpha”, April 2021

[4]Source Bloomberg

[5]OECD, “ESG Investing: Practices, Progress and Challenges” https://www.oecd.org/finance/ESG-Investing-Practices-Progress-Challenges.pdf, p 28

[6]Source Bloomberg

[7]Source Bloomberg: FTSE USA All Cap Choice (FGCUSAC

[8]Brad Barber, Adair Morse, Ayako Yasuda, “Impact Investing”, Journal of Financial Economics, January 2021