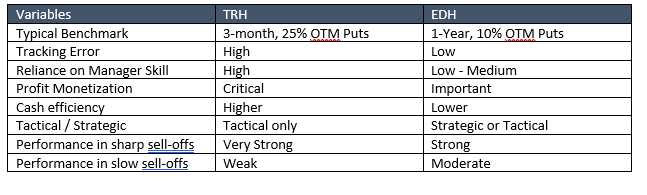

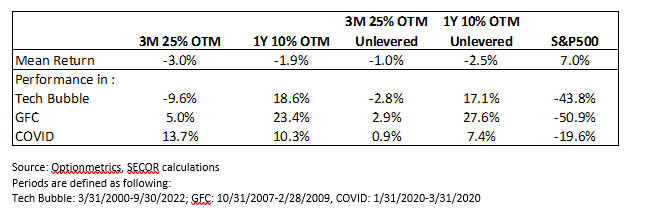

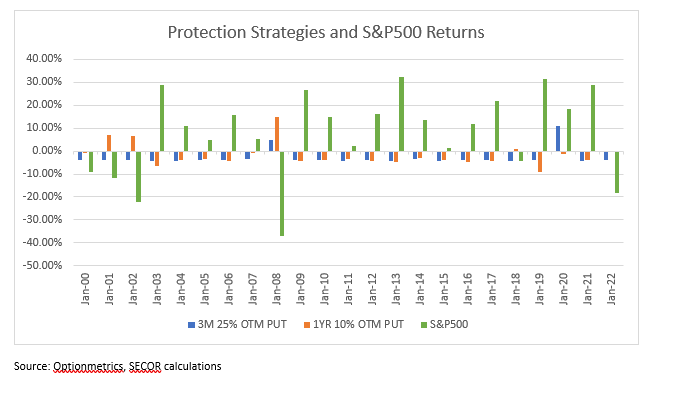

The table and the chart indicate that apart from the COVID sell-off, 1Y10 strategy provided a much stronger crisis performance than 3M 25% OTM. The differences were particularly stark during the technology bubble unwind, when a bear market lasted for a long time and 10% OTM options frequently settled in the money while 25% OTM 3-month options expired worthless.

The table also demonstrates that implementing the strategies with a constant-spent premium impacts performance differently depending on the type of equity sell-off: it helps when the sell-off starts from a very low level but hurts in the environment of GFC. It also helps when sell-offs are not large as the constant premium strategy does not buy as many options when they are expensive.

Evaluating Strategies

It’s particularly important to note that since options periodically settle in-the-money, the realised annual bleed for both strategies were lower than the 4% per year annual premium spent. Thus, investors should not equate an option premium with an expected cost of the program, it is much more accurate to evaluate the programs in terms of their expected return, which would depend on their benchmark and assumptions about manager alpha.

Given that 3M25 benchmark has a much higher bleed, why do some investors prefer this type of the program? The answer is three-fold: (i) it may provide higher convexity, (ii) TRH managers tend to monetise options before they expire, and (iii) betting on extreme outcomes usually allows managers to source protection somewhat cheaper than simply buying 25% OTM equity options.

Convexity profile is indeed more attractive for the 3M25strategy. Using the option, mentioned in the above example, which was priced at $0.25 at the time of the purchase, if equity markets went down 20% in one month after the purchase and implied volatility increased to 50%, the price of the option would increase to $5.4 – a 21x increase. The forementioned annual option would “only” increase in value 5.3x. Thus, when betting on extreme events 3M25 appears to be more attractive if the timing of this bet is extremely accurate.

Timing of monetisation and manager’ skills are much more important for the 3M25 program since without intervention, its bleed is double that of the 1Y10 program. Thus, TRH managers tend to have much higher tracking error to their benchmark than EDH managers. Furthermore, TRH managers aim to identify opportunities to create exposure to large equity market events by using exotic options, which may benefit from changing market correlations and events in fixed income or FX markets. This tends to reduce premium spent, but further increases tracking error.

Since EDH managers need to deliver smaller alpha for the program to break-even over the long-term, their need for tracking error budget tends to be lower. While they can use the same strategies as TRH managers, a set of simpler tools may also provide value. For example, they can substitute a portion of benchmark exposures with either other, relatively cheaper option structures, such as spreads, or even with linear strategies such as Trend. Given their lower tracking error, 1Y10 benchmark provides better guidance for long-term returns and, therefore, maybe easier to evaluate for a strategic allocation within institutional framework.

Conclusion

We believe that the two types of protection strategies discussed in this note – TRH and EDH – have their unique characteristics and their evaluation requires different approaches. Given TRH strategies’ higher reliance of managers alpha, these strategies are more likely to end up in an “alpha” or “special opportunities” bucket, while EDH strategies maybe better suited for strategic allocation since their benchmark and alpha requirements maybe better understood.