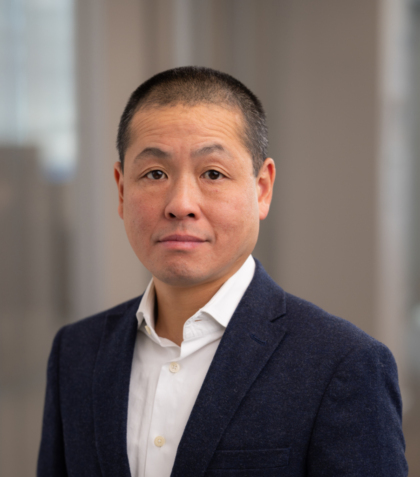

Kam Chang

Head – OCIO & Fiduciary Management

kam@secor-am.com +44 (0)20 3750 0668

Kam is the Head of OCIO & Fiduciary Management at SECOR, leading our client advisory, manager research, and plan management efforts. Kam is also the Head of our UK and European business. He is a member of the ESG Committee. He has over 25 years of investment management industry experience, including time at General Motors Asset Management in a variety of portfolio management roles for multi-asset, fixed income portable alpha, and alternative high yield strategies. Kam holds a BS in Finance from New York University and an MBA in Finance and Management from Cornell University.