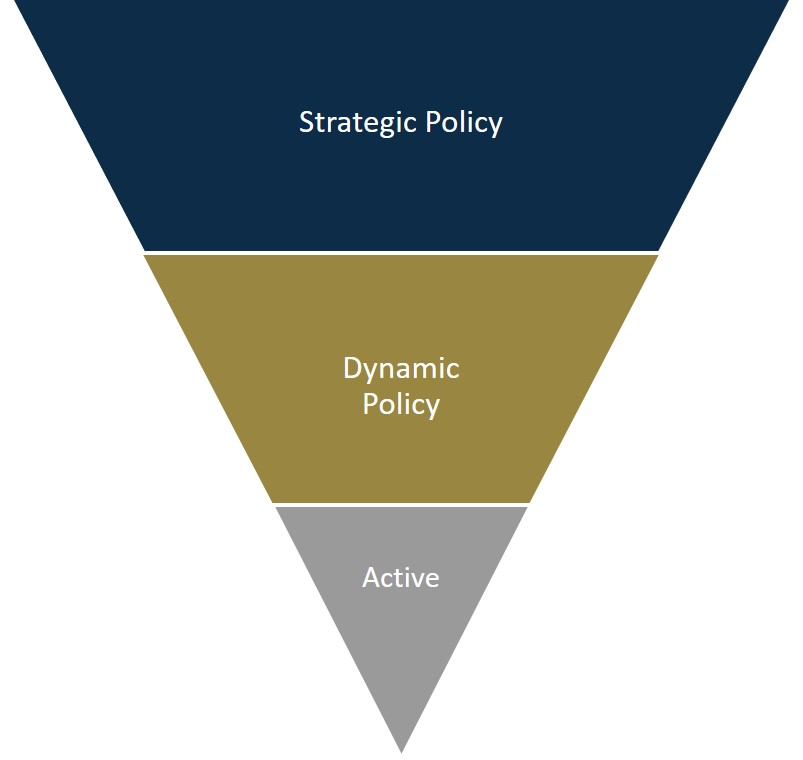

Strategic Policy

Through our Strategic Policy setting advice, we help our clients determine their ultimate objectives and translate this into a strategic asset allocation. Before discussing funds, products and solutions we focus on defining the bigger picture. Most of the expected investment return is governed by the Strategic Policy.

Dynamic Policy

Dynamic Policy allows for some room to manoeuvre different market conditions. Tactical asset allocation decisions can be made to take advantage of extreme market dislocations and would be governed by this policy.

Active Risk Budget

An Active Risk budget will determine the amount of return we would like to achieve from active management. The budget is set to allow for some active management but should not overly influence the overall risk profile of the scheme.