Inflation and hedge funds – hidden opportunities and risks

By Angela Xu, CFA

March 2022

Inflation, and the future path thereof, has been a major theme dominating markets over the past six months. Markets seem to have, for the most part, priced in inflation persistence, but continue to vacillate on the strength of inflation pulse and the ability of central banks to control inflation in the long term.

Such an environment presents attractive opportunities for hedge fund managers. With fixed income and equity beta expected to underperform, hedge funds are particularly valuable due to their absolute return nature and flexible mandates across investment styles and asset classes. We believe that hedge funds are uniquely positioned to navigate the current and future inflationary market gyrations.

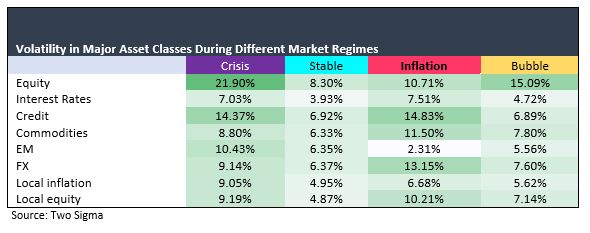

First, inflation creates heightened volatility across asset classes. An analysis performed by Two Sigma Investments using a machine-learning Gaussian Mixture Model (GMM) classifies market environments over the past 50 years into crisis, stable, inflation, and bubble categories[1], highlighting:

- Volatility is heightened across asset classes during inflation periods

- An inflationary regime is a persistent regime that can last for many years. Higher persistent volatility results in greater dislocations and dispersion within asset classes – which is generally beneficial for actively managed strategies

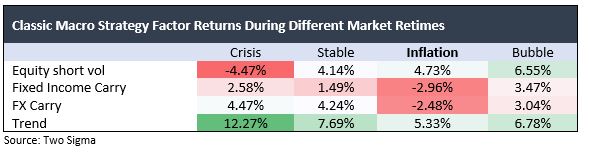

Second, a variety of hedge fund strategies can benefit directly and indirectly from rising inflation. On the front lines, inflation traders can directly access and trade dislocations within inflation derivative markets. For example, European and UK inflation derivatives are less liquid and more heterogeneous than their US counterparts. Specialised knowledge in these niche markets can contribute alpha to the broader portfolio. Specialised commodity traders are also positioned to benefit as inflation usually is accompanied by trending commodity markets.

More broadly, rising inflation means changes in monetary policy and higher fixed income volatility. Fixed income relative value and discretionary macro strategies may stand to benefit. Quantitative tightening and higher interest rate volatility means greater dislocations in the front-end fixed income markets, which favour relative value trading. Fixed income volatility also benefits discretionary macro strategies, which tend to include a large component of thematic fixed income trading strategies. However, due to the relative concentration and directionality of their portfolios, manager selection is especially important.

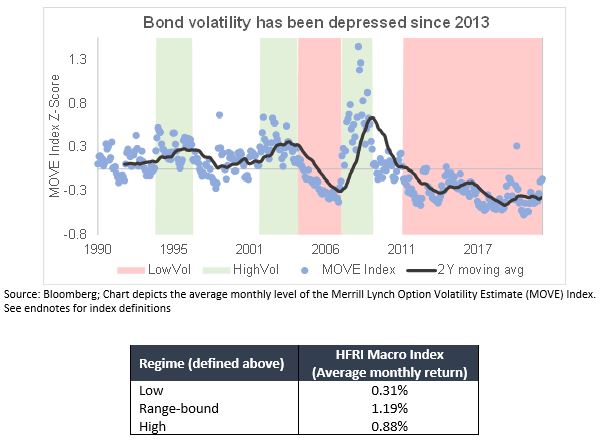

We use the average monthly level of the Merrill Lynch Option Volatility Estimate (MOVE) Index as a proxy for fixed income volatility from 1990 to January 2022. Dividing the time series into 3 different regimes – high volatility, low volatility, and range-bound – we calculate the average return of the HFRI Macro Index in the different regimes. We find that macro strategies perform the best during periods of range-bound volatility. As expected, returns are lower during periods of high volatility (usually crisis periods. Interestingly, they tend to perform the worst in periods of low fixed income volatility, which has been the dominant regime since 2011. Based on this analysis, macro strategies may experience noticeably higher returns if fixed income volatility rises and persists at a higher level.

So far, markets have been pricing in the inflationary impulse within the context of strong real growth. This is translated into an outperformance of value, particularly energy, which are indirectly embedded in many hedge funds strategies. Value-oriented equity have obviously benefitted. The rotation has also trickled through to some credit and distressed debt strategies, which often contain value-oriented securities.

On the other hand, it’s important to manage risks as well. While inflation is generally good for active strategies, market regime transition is typically not. Emerging market carry strategies may suffer in the medium term as the yield gap between EM bonds and US Treasuries narrow. Afterwards, emerging market countries will exhibit dispersion in attractiveness depending on their relationship to commodities, economic growth, and monetary and political stability.

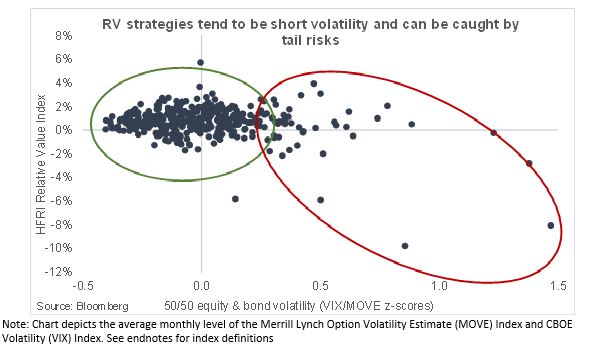

In addition, relative value strategies, including statistical arbitrage and many multi-strategy funds, tend to be highly levered and intrinsically short volatility (long mean reversion). Market seizures and volatility spikes during regime change can trigger deleveraging, which can pose tail risks to various types of relative value strategies.[2]

All in all, rising inflation presents opportunities for hedge funds, but risks abound over the regime transition period. The potential for deleveraging and market contagion can make investors consider some form of portfolio protection in the form of tail hedging and diversifying strategies. Certain hedge funds are capable of being long volatility, which is a valuable tool for multi-asset portfolios.

In such an environment, manager selection and exposure monitoring become notably more important when constructing a hedge fund portfolio. Strategy selection can be used to tactically position the portfolio for an inflationary era while manager selection will be crucial to mitigate downside risk and add alpha.

[1] A Guassian Mixture Model uses a clustering method to break down markets in the past 50 years into 4 regimes, using returns from 17 factors. The regimes are separated by the model and are categorised afterwards based on factor performance in each of the clusters. A Machine Learning Approach to Regime Modeling – Two Sigma

[2] Sources: Bloomberg, Two Sigma, SECOR Analysis

Definitions

MOVE Index: The Merrill Lynch Option Volatility Estimate (MOVE) Index is a yield curve weighted index of the normalised implied volatility on 1-month Treasury options which are weighted on the 2, 5, 10, and 30 year contracts.

CBOE VIX Index: The VIX Index is a financial benchmark designed to be an up-to-the-minute market estimate of the expected volatility of the S&P 500® Index, and is calculated by using the midpoint of real-time S&P 500 Index (SPX) option bid/ask quotes. More specifically, the VIX Index is intended to provide an instantaneous measure of how much the market expects the S&P 500 Index will fluctuate in the 30 days from the time of each tick of the VIX Index.