Is the Dollar’s Preeminent Role in the Global Economy Finally in Jeopardy?

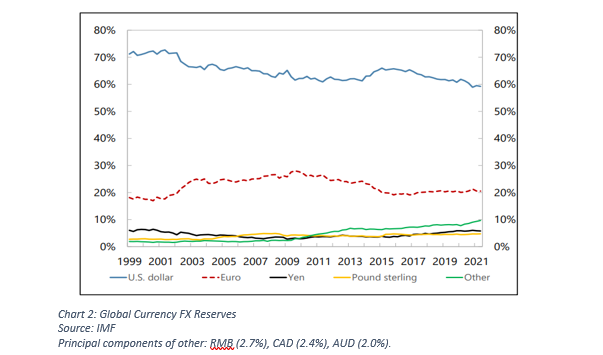

Over the last eighty years the U.S. dollar (USD) has served as the world’s preeminent currency even though friends and foes have expressed resentment, particularly at the privileged access to credit that the US has enjoyed as a result of its dominant currency. Other currencies such as the euro, Japanese yen, and British pound sterling play important roles in the global economy, but the U.S. dollar (USD) continues to occupy the dominant position.

Now China’s emergence as an economic and geopolitical rival of the US, new technologies, and the expanding role of the USD as a vehicle for economic sanctions are bringing new and perhaps even more compelling reasons to contend that at long last the dollar could be dethroned from its preeminent position.

In this opinion piece on the prospects for de-dollarisation we discuss the following:

- Economic, market, and institutional underpinnings of dollar’s dominant role

- Is there an alternative to the USD: renminbi, gold, digital currency?

- Could geopolitics trump economic efficiency?

- Our opinion: Dollar’s global role may evolve but its preeminence is likely to persist[1]

Economic, Market and Institutional Underpinnings of Dollar’s Dominant Role

The US economy accounts for only 12% of world trade and roughly 20% of world GDP, yet current financial data attest to the preeminent role of the US dollar in the global economy. The US dollar’s leading role in foreign exchange, trade, and international finance is manifest across the following metrics: cross-border loans, international debt securities, FX transactions, official FX reserves, trade invoicing, and SWIFT payments. The USD was involved on one side or the other of nearly 90% of global FX transactions in 2022. Moreover, forty percent or more of cross-border loans, international debt securities, trade invoicing, and SWIFT payments were dominated in USD in 2022 (see Chart 1).

Economic, Market and Institutional Underpinnings of Dollar’s Dominant Role

The US economy accounts for only 12% of world trade and roughly 20% of world GDP, yet current financial data attest to the preeminent role of the US dollar in the global economy. The US dollar’s leading role in foreign exchange, trade, and international finance is manifest across the following metrics: cross-border loans, international debt securities, FX transactions, official FX reserves, trade invoicing, and SWIFT payments. The USD was involved on one side or the other of nearly 90% of global FX transactions in 2022. Moreover, forty percent or more of cross-border loans, international debt securities, trade invoicing, and SWIFT payments were dominated in USD in 2022 (see Chart 1).