[1] Federal Reserve Bank of New York, “Secured Overnight Financing Rate Data”, The Federal Reserve Bank of New York, New York, 2021

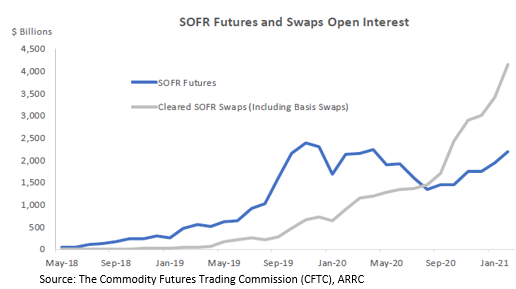

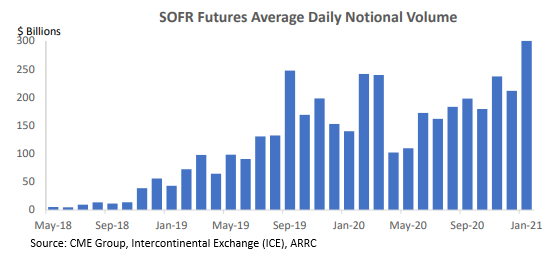

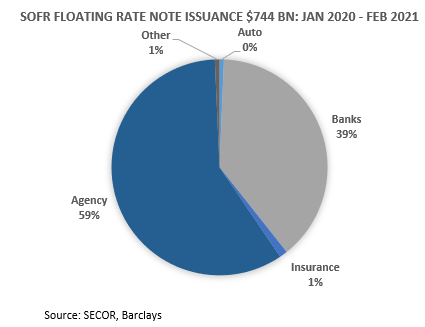

[2] The Alternative Reference Rates Committee, “Progress Report: The Transition from U.S. Dollar LIBOR”, The Federal Reserve Bank of New York, New York, 2021, p. 6

[3] Board of Governors of the Federal Reserve System (Fed), Federal Deposit Insurance Corporation (FDIC), Office of the Comptroller of the Currency (OCC), “Statement on LIBOR Transition”, The Fed, FDIC, OCC, November 30, 2020

[4] Cessation Dates = Immediately following publication on December 31, 2021 for 1-week, 2-month USD LIBOR and June 30, 2023 for overnight and 1, 3, 6 and 12-months USD LIBOR settings

[5] CME Group, “Secured Overnight Financing Rate (SOFR) Futures”, CME Group, Inc, Chicago, Illinois, 2021

[6] The Alternative Reference Rates Committee, “Progress Report: The Transition from U.S. Dollar LIBOR”, The Federal Reserve Bank of New York, New York, 2021, p. 8-15

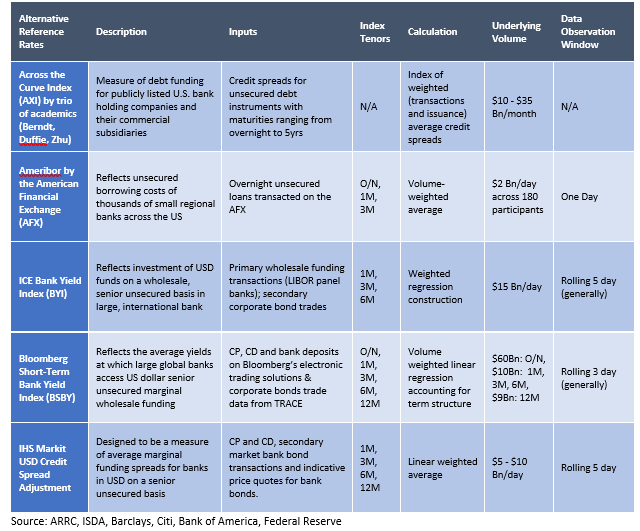

[7] Schrimpf and Sushko, “Beyond LIBOR: a primer on the new reference rates”, Bank for International Settlements, Basel, Switzerland, 2019, p. 30-31

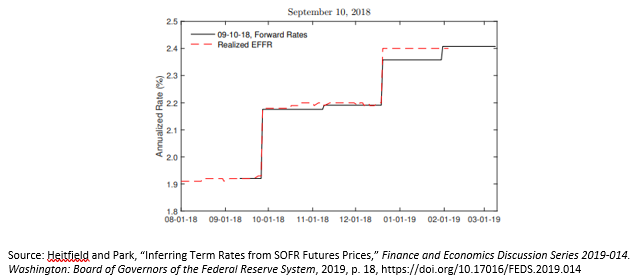

[8] Alternative Reference Rates Committee, “ARRC Provides Update on Forward-Looking SOFR Term Rate: Market Participants Encouraged to Transition without Reliance on SOFR Term Rate”, The Federal Reserve Bank of New York, New York, 2021

[9] The Effective Federal Funds Rate (EFFR) represents the volume weighted annualized overnight rate at which major banks borrow unsecured overnight funds to meet reserve requirements. SOFR and EFFR have a correlation of ~0.99 based on daily observations from April 2018 – April 2021. Unlike EFFR, SOFR rates may experience short-term spikes when there is stress in overnight repo markets.

[10] Liu and Bai, “Forward-looking Forward Rates: An Indicative SOFR Paradox”, FactSet Research Systems, Chicago, IL, USA, March 2021, p.14

[11] Bowman, “Perspectives on Issuing and Implementing SOFR-Based Loans”, Board of Governors of the Federal Reserve System, Washington, D.C., March 2021

[12] Schrimpf and Sushko, “Beyond LIBOR: a primer on the new reference rates”, Bank for International Settlements, Basel, Switzerland, 2019, p. 50

[13] Mnuchin, Powell et. al, Letter to bank representatives, Federal Reserve, SEC, OCC, FDIC, US Treasury, March 2021