LDI Program

We create and implement sophisticated LDI programs that are both transparent and rigorous, using the most appropriate experts for each step in the process:

- Actuarial Liability – we work in partnership with the scheme actuary to value the scheme liabilities

- Investment Risk Model – we create a liability model and work with the scheme actuary to ensure close alignment with scheme liabilities

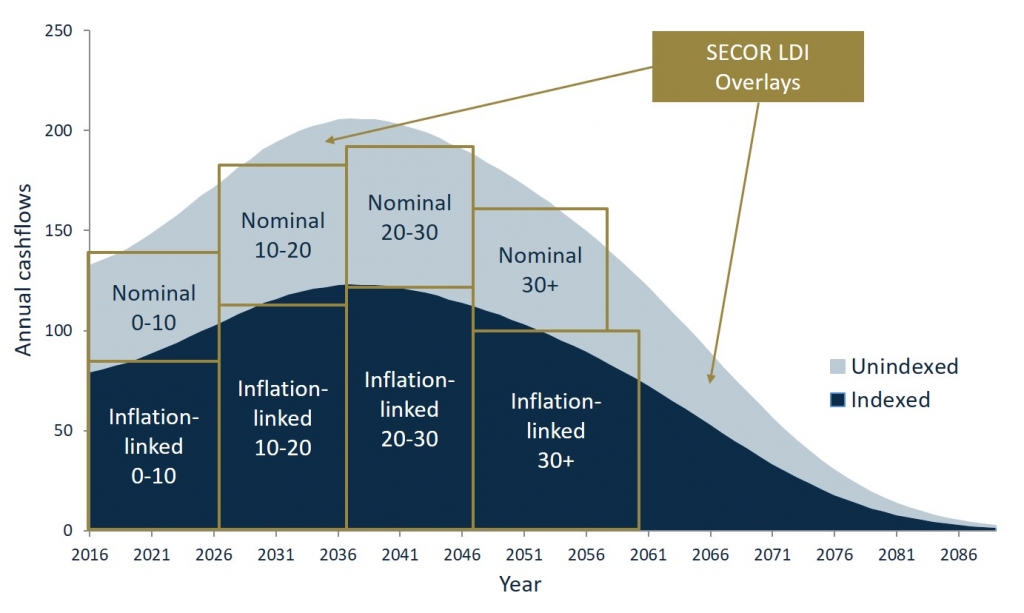

- LDI strategy – we specify a practical, achievable mix of hedge components that match the true interest rate and inflation risk profile of the liabilities

- Delegate mandates – we provide investment managers who are part of the LDI solution with clear mandates against market-driven benchmarks

- LDI overlays – for a more precise implementation we can also use derivative overlays to fine-tune the accuracy of the hedge of the liabilities