What is Equity Downside Protection?

Equity downside protection is an investment solution that helps clients remain invested in equities to benefit from potential market gains, while reducing the potential impact of equity market losses.

These solutions typically involve the use of derivative contracts, which can conceptually be thought of as a form of equity portfolio insurance.

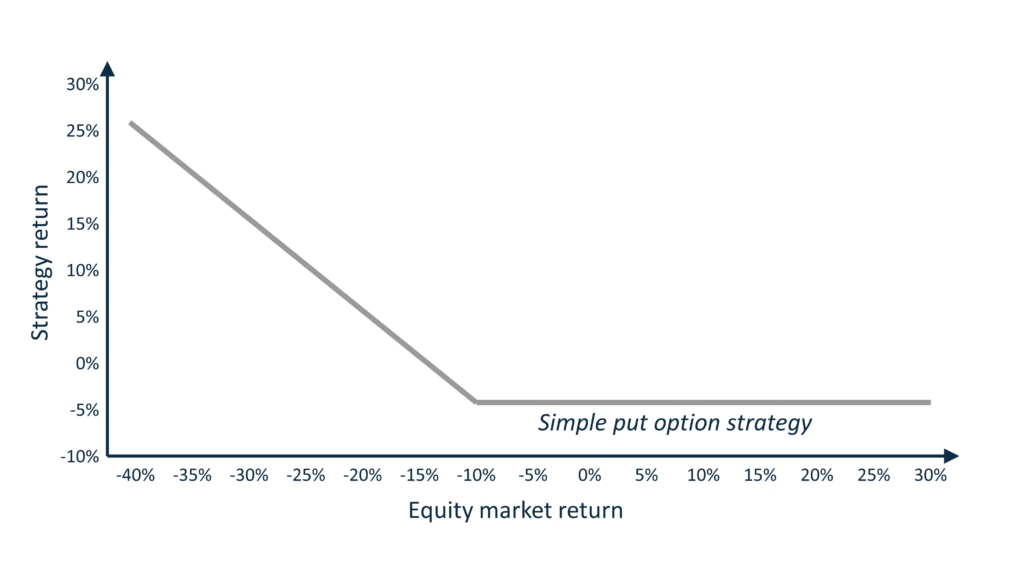

The chart represents the shape of the payoff of a simple put option. As illustrated, the option will provide protection when the equity market falls more than 10% but will ‘cost’ 4.5% of the equity return.